We offer scalable investment products, foster modern solutions and provide actionable insights across sustainability problems.

Failure of a company to qualify as a REIT underneath federal tax regulation might have adverse implications with a client account. Additionally, REITs have their particular costs, and a client account will bear a proportionate share of All those fees.

"About-diversification" tends to occur when there are actually previously a super amount of securities in a portfolio or If you're incorporating carefully correlated securities.

"Among the list of cruel facts about portfolio diversification is always that it may or may not pay back in almost any presented time period," admits Morningstar portfolio strategist Amy Arnott.

With the earlier 7 several years, Kat is aiding men and women make the most beneficial financial conclusions for their one of a kind conditions, whether they're searching for the proper insurance coverage guidelines or looking to fork out down financial debt. Kat has knowledge in insurance policy and pupil financial loans...

Initial, there are actually the risks affiliated with investing in dividend-spending stocks, such as although not restricted to the risk that stocks within the Strategies may perhaps lower or halt shelling out dividends, impacting the Technique's capacity to produce income.

With the opportunity for tax-totally right here free growth and tax-free withdrawals in retirement,3 a Roth IRA may help you maintain more of Everything you gain.

On this Specific report, we response a lot of the crucial questions investors have about what portfolio diversification is, how to obtain it, and why proficiently see this page diversifying an investment portfolio may very well be getting harder to accomplish within the facial area of increasing interest rates and inflation.

If eligible, your business could have a hundred% of plan startup expenditures included through compact business enterprise tax credits, which implies your program may very well be almost free for the 1st 3 yrs.

Only workers make contributions towards the account, and there are no filing needs for your employer. Payroll deduction IRAs are simple to put in place and function, and There's tiny to no cost to the employer.

If you think your income taxes are better now, contribute to a standard 401(k) account and profit from reduce taxes on withdrawals in retirement. If you're thinking that you’re possibly within a reduce tax bracket now than you will end up in retirement, a Roth 401(k) account is actually a better choice.

Our automatic investing solutions can Establish and handle your portfolio utilizing modern technological know-how with Expert assist obtainable whenever you will need it.

In case your employer provides a plan that will help you preserve for retirement, you should Nearly absolutely decide-in since they can definitely assist you to jumpstart your retirement savings. But where you get the job done will affect what kind of retirement options you may have.

Because our founding in 1935, Morgan Stanley has persistently delivered 1st-class business in a first-course way. Underpinning all that we do are 5 core values.

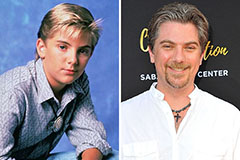

Jeremy Miller Then & Now!

Jeremy Miller Then & Now! Shannon Elizabeth Then & Now!

Shannon Elizabeth Then & Now! Soleil Moon Frye Then & Now!

Soleil Moon Frye Then & Now! Suri Cruise Then & Now!

Suri Cruise Then & Now! Bill Murray Then & Now!

Bill Murray Then & Now!